Is this strategy right for you?

- This strategy is for people who can’t buy a million-dollar Auckland house, but who believe that investing in property will help them build wealth.

- It’s for parents who want to help get their kids set up for the future in a formalised, legal vehicle.

- It’s for people who have realised they will never be able to achieve this through saving alone.

- You don’t need a big lump sum of cash, or to be earning enough to qualify for a big mortgage.

- It’s for people who might prefer to keep renting somewhere nice while they build enough capital to afford a home they actually want to live in, in a suburb they love.

- You do need to be able to scrape together or access $100k, either from yourselves, the bank, or the bank of Mum and Dad.

How It Works

A personal prosperity model for the golden years

- This strategy is for people who own their own home but know they need to invest to secure their future.

- It’s for people who are wondering how they will be able to afford their retirement, which we have analysed will need something like $1.5m for an Aucklander, on top of owning their home.

- It’s for people who want to leave their kids the gift of financial security after they’re gone.

- It’s for people who have worried about money all their lives and just want something they can understand to provide peace and security for their golden years.

How It Works

Why housing is a popular investment

To invest in shares, fixed interest, debentures or KiwiSaver you need CASH. Most of our investors have no cash, have never had any cash, and unless they foolishly embark on ‘saving’, never will. Yet spectacular wealth is made decade after decade on property. None of us were taught financial literacy and at Real Estate Together we are not financial advisers but we will illustrate how this all works.

Property investment in Auckland has always been a strong investment choice for Kiwis, and for the first time ever it’s cheaper to buy property in Auckland than rent it, making now the ideal time to invest.

There is a huge demand for affordable housing in Auckland due to immigration, more Kiwis moving to Auckland from elsewhere in New Zealand, and our strong economy. Statistics New Zealand forecasts that Auckland will need 400,000 new homes over the next 30 years to cope with demand.

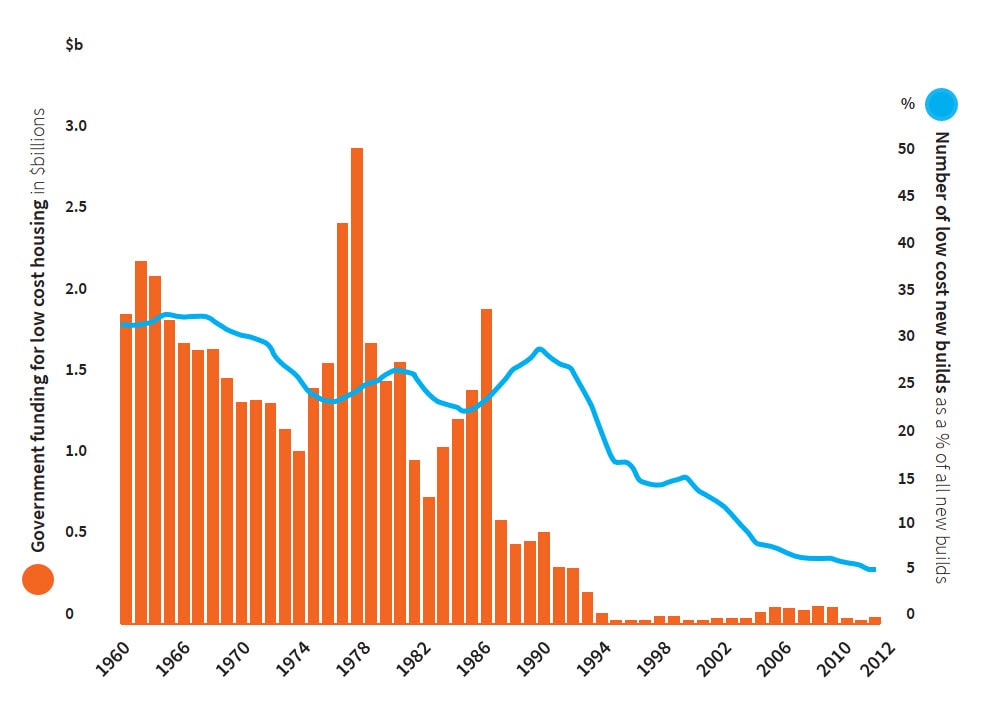

Yet there has been a huge drop off in the number of affordable homes being built in Auckland due to a reduction in government spending in this area. The number of affordable homes that have been built since 1990 is 70% lower than in the 30 years previous, according to 2018 data from the Institute for Economic Research.

The huge drop in supply coupled with increasing demand makes Auckland housing a popular investment choice. However it also means that house prices have increased to the point where the average Kiwi is struggling to save enough to afford their first home, or to buy a house as an investment for later in life.

This is why we’ve created Real Estate Together, to help more Kiwis get onto the property ladder.

Receive expert analysis and commentary on the Auckland housing market from Martin directly to your inbox each month

Risks and Considerations

Property values are tied to interest rates, how many buyers there are for your property, and how many others are also selling their properties at the same time. You may risk losing capital on your initial investment when you sell.

Buying a property can tie up your savings. If you invest most or all of your cash in property and then need access to cash, you’ll either need to sell, tenant your property or increase your mortgage. This isn’t always easy and there are usually fees involved. Your ability to sell your investment will also be dependent on the terms of your Co-Op Contract, if applicable.

Most people pay a deposit and borrow money to invest in property. Ask yourself how much debt you can afford to take on. Use your bank’s mortgage repayment calculator to find out how much you need to repay per month, and how much of your income is left to pay other household bills.

If you cannot find tenants, you will be required to cover the mortgage payments while there is no rental income. Make sure you have enough savings to cover these unexpected costs.

Your mortgage repayment will rise when interest rates go up, affecting your disposable income. A 0.5% rise in interest rate to 6% for a loan of $300,000, fixed for 30 years, would add about $110 more to your mortgage each month, or a repayment of around $1,800 per year.

If interest rates fall, and you choose to refinance a mortgage rate that has been fixed for a number of years, you might need to pay a penalty fee for breaking the terms. This may make your total loan repayment more expensive. It’s also possible to end up owing more than your property’s worth if its value drops. This is known as negative equity.

You need to think about your intentions when you first agree to buy a property. What you intended to do will determine your tax situation when you come to sell. If you buy with a firm intention to resell the property, then you will have to pay tax on any profit you make. This is separate to the brightline test. The intention to sell does not need to be the main reason for buying the property – it could be one of a number of reasons for buying.